Typically the stocks will lead the commodity. Relative weakness of stocks against the commodity is always a warning sign. Remember 2007–2008? In the chart below, we show SLV along with four silver stocks charted against SLV. Prior to the big breakout at the end of the summer, three of the four stocks were outperforming silver. Today, silver is within a hair of its high yet the stocks are badly lagging.

There are other reasons to be cautious. Silver remains a whopping 34% above its 200-day moving average. SentimenTrader reports that public opinion was 71% bulls as of last week. It's likely even higher now. Does this all sound like a precursor for another silver breakout? In four and a half months, silver gained over 70%. The market will digest that move before beginning another impulsive but sustainable advance.

Gold, on the other hand, has a better risk-reward setup over the medium term.

Various sentiment indicators suggest there is very limited downside. The recent Commitment of Traders Report (COTS) showed that open interest was 26% below its recent high, while the speculative long (non-commercial) position was 31% off its high. A few weeks ago, we saw that the Central Gold Trust (GTU) Premium to NAV was negative.

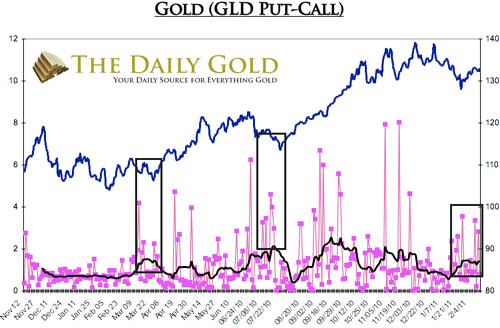

Finally, consider the GLD put-call (data from ISE), which we track in our premium service. The 10-day put-call moving average (MA) is at a two-month high and rising. This shows some skepticism in the market. By the way, we don't see this in SLV.

Gold is underperforming because it has taken a backseat to risk assets. With stocks performing well, the mainstream can ignore gold. Yet, when stocks begin to hit resistance, gold will regain leadership and outperform both stocks and silver. That may not happen in the next week or month but we believe it is coming soon.

Meanwhile, silver has rebounded nicely but our work shows that short-term risk is increasing while the odds of a sustained breakout are low. Yes, physical supply is very tight, there is manipulation in the market, there is backwardation and Comex inventory is low. However, what is the market saying about that?

Silver has yet to make a new high and the silver stocks are skeptical. Perhaps these bullish fundamentals were priced in months ago, during silver's monstrous advance? Those who ignored the market in 2008 got killed. Those who are banking on an immediate breakout and move to +$40 will likely be disappointed.

Let it be known that I believe silver will outperform gold over the long term. Most of the stocks we hold in our model portfolio are silver stocks. Check the archives of this website and you will find several articles from us touting silver and silver stocks in 2010.

In our premium service we have reduced our risk by exiting non-core silver positions and building cash. In the meantime, we are researching and patiently waiting for opportunities to accumulate gold and silver juniors that can rise substantially in the next year or two. Consider a free 14-day trial to our premium service so that you can gain from our top notch market timing skills and company research.

Good Luck!

Jordan Roy-Byrne, CMT

[email protected]

Subscription Service