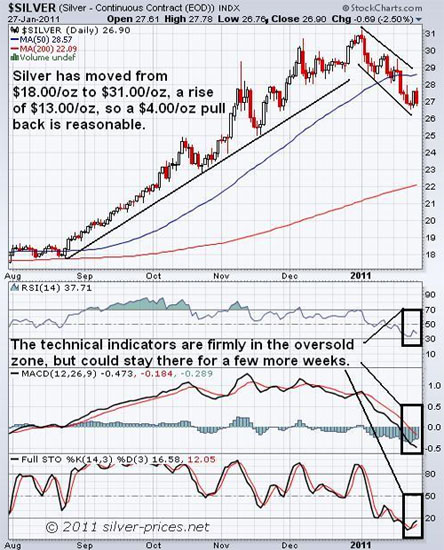

Silver has moved from $18–$31.00 an ounce, a rise of $13/oz.; so a $4/oz. pullback is reasonable. The technical indicators are firmly in the oversold zone but could stay there for a few more weeks as this correction runs its course. The upside is that the technical indicators are languishing at low levels, so when silver prices do resume their trek north—and they will—the next upleg could be astonishing. If you are not already in this tiny market, you should be preparing to make your move.

We have a had a $4/oz. correction and there may be some more to come, but then we will have an excellent buying opportunity presented to us. We haven't moved because we are tight and we also wrestle with which is the best place to invest—the metal or the stocks. But there is a good argument for bagging a few of your favorite stocks right now and sitting on them until year-end at least.

When silver prices do change course, the stocks should do well; but we think it is prudent to buy the physical silver first and take delivery of it before you go a plundering on the TSX.

King World News just interviewed a top U.S. gold and silver dealers about tightness in the silver market. CMI Gold & Silver Owner Bill Haynes stated the following when asked about a shortage in silver:

"All of the major suppliers of 100 oz. silver bars are either weeks or months out; some won't even take orders. I had conversations with a number of people who buy from them. . .and some of them revealed that they thought the refineries were having trouble and the manufacturers were having trouble getting the physical product, which falls right into the silver shortage."