So if the banks are not making loans, what are they doing with depositor money?

Well, they are still lending, but not to businesses and consumers. They are lending to the federal government.

Banks don't lend directly to the federal government of course, but buying U.S. government paper accomplishes the same thing. Depositor money is sent to the federal government, either directly when banks purchase newly issued government paper or when they purchase it paper from others.

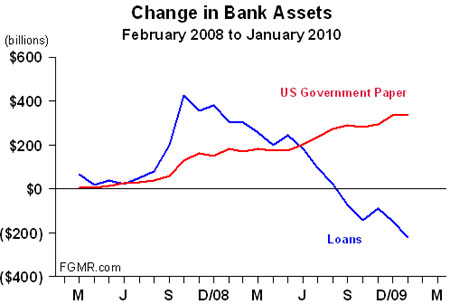

If the financial crisis began with the collapse of Bear Stearns in March 2008, Fed data shows that since then bank lending has declined by $220 billion. During this same period, banks increased the amount of U.S. government paper they hold by $337 billion.

The change is even more dramatic when viewed from the peak of bank lending that occurred in the aftermath of the Lehman Brothers collapse. Companies cut off from the commercial paper market turned to banks for liquidity. Drawing down their credit lines caused bank loans to surge; bank loans have declined $646 billion from their October 2008 peak.

This significant shift in bank assets has implications for the economy and the USD.

Instead of depositor money being used to stimulate economic activity in the private sector by lending to businesses and consumers, the banks are helping to fund the growing federal deficits. This reallocation of resources has a negative long-term impact on the economy. Depositor money is not being used productively—to create jobs and grow the economy. It's being spent by the government, which consumes in the present and does not invest for the future.

This shift in bank assets also has negative implications for the dollar. As the realization grows that the financial condition of the Fed is not much different from Greece, the value of U.S. government paper declines. Debasement of the dollar is inevitable as banks funnel depositor money into U.S. government paper instead of making loans.