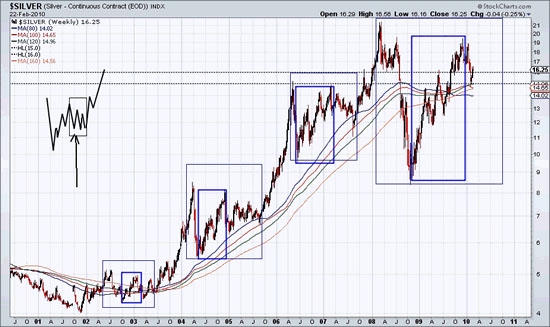

So what now? The pattern implies that silver will grind lower over the next four to six months, before beginning another impulsive advance. Judging from past corrections, silver could decline to as low as $12 or $13. Note the strong lateral support at $15, as well as the long-term moving averages clustering from $14 to $15.

Take a look at a 45-year chart and you'll notice that the upcoming bottom could be a major opportunity.

There is a problem with the recent data feed as it obfuscates the end of the chart but it doesn't affect our analysis. Other than major resistance at about $20 and a bit of resistance at $25, it is clear skies ahead for silver. We should also note the beautiful long-term cup and handle formation. The handle would be market action over the past two years.

Refer to our first chart and you'll notice that since March 2008, silver has thrice failed at $19. Needless to say, a close above that $19–$20 resistance could be very significant and would trigger a tremendous advance close to the spike high in 1980.

The technical outlook for silver is part of the reason we are super bullish on the junior silver companies. We believe these companies will be the real stars of the next several years.