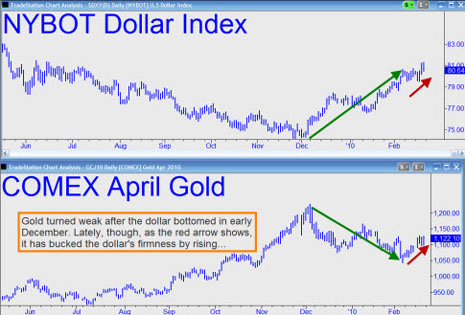

Note that the price of gold declined more or less proportionally when the USD started to rally in early December. Their inverse movement stayed pretty close until recently, with the Dollar Index rising 9.5% off its lows as gold futures fell by 8.7%. But starting about two weeks ago, gold began to rise even when the USD was firm. To be sure, the dollar's steep upward trajectory has flattened some since early February. But it has risen about 0.25% nonetheless, presumably consolidating for another thrust. Despite this, gold has managed to eke out a 6.5% gain over the same time—a performance that should hearten investors who have patiently awaited an end to a correction that is now in its third month.

$1,085 'Worst Case'

For now, though, the dollar appears bound higher. Hidden Pivot analysis suggests that the immediate upside potential of the Dollar Index is about 3.3%. A corresponding decline in gold would bring the April Comex contract down to $1,085—hardly a disaster, considering that gold has already been down as low as $1,044 since the December top. If that's as bad as it gets, it should put no great strain on the nerves of gold investors, even if it tests everyone's patience.