There are myriad reasons for silver's lackluster performance, not the least of which is the fact that it's an industrial metal as well as a precious metal. Industrial use, in fact, outstrips jewelry fabrication demand by more than a threefold factor. Silver is a component in batteries, bearings, solder and brazing materials as well as electronics. In an economic downturn, demand for these materials naturally declines. Add to that the diminishing role of silver in photography in the digital age and you have a very elastic price.

Gold, by comparison, has limited industrial utility. Its price mainly reflects jewelry and investment demand.

Silver's recovery to its former highs, then, seems more likely in a booming economy when industry is cooking. Plainly, that's not now.

That's not to say that silver won't have its—ahem—shining moments. It does, after all, run alongside gold with an 82% correlation. Gold just isn't dragging the ball and chain of an economic recovery around with it.

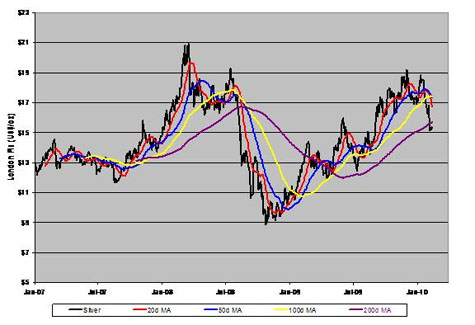

This morning, London silver rose 49 cents an ounce to $15.82 to get within spitting distance of its 200-day moving average. The white metal crashed below the average in last week's sell-off.

Some hopeful investors believe that, because silver fell harder than gold, there's a more explosive recovery due. Perhaps. But the one element most likely to lift silver up to challenge its former highs is a broad-based economic resurgence. What are the odds of that?