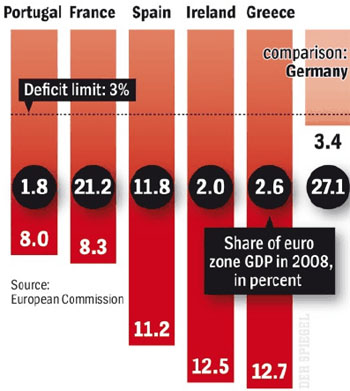

You may have seen many charts about the size of the European countries' deficits before, but I find this one the most intriguing. Here you can see that Greece has a budget deficit of 12.7% of GDP BUT it constitutes only 2% of the entire Eurozone's GDP. Much more worrying for the euro is the size of deficits for both Spain and France when you take into account their percentage of Eurozone GDP, which add up to over 30% of the total.

This needs to be taken into consideration with the looming public debts each country holds. Portugal, for example, has a debt to GDP ratio that is set to hit 85% this year. Greece's is almost 113%.

The Weak Euro Effect

Weaknesses in the European countries have inevitably played out in the markets.

The following chart plots the Euro Index over a 1 year period. What’s noticeable is not that it has declined recently, but that it has much further to fall.

In response, the gold price recorded its highest ever gold fix in euros yesterday—808.072.

In the very least the euro has been dealt a heavy blow. Confidence in its durability has been questioned. The real effect should be played out in countries that were looking to diversify away from huge dollar reserves. In their eyes, the uncertainty in the euro will add to the appeal of gold. These are bullish signs for gold. Could a new bull rally be coming soon? It looks likely, but we have to keep an eye on the euro, the U.S. economy and other factors.