Breakouts from triangles have a special significance. During the formation of the pattern the fundamentals are uncertain and the price bounces up and down reflecting this indecision and hesitancy. But at the point of breakout all the uncertainty is resolved into a new set of fundamentals that dominate the next upward surge. A large degree of the uncertainty stemmed from the sub-prime rate problems in the US. The tidal wave effect of this crisis caused doubts to be cast on the future direction of consumer spending and global growth. However the central banking system has made it abundantly clear that they have rallied round to cut rates in order to attempt to alleviate the major effects of the sub-prime debacle.

I attended a very interesting presentation a week ago at the monthly TASSA (Technical Analyst’s Society of Southern Africa) meeting that discussed the sub-prime difficulties and the reasons for the debacle. According to the speaker it transpired that financial houses in the US bundled together parcels of BBB rated bonds and somehow persuaded the rating agencies such as Standard & Poor, Moods and Fisk to rate them as an AAA risk. The bottom line is that this is tantamount to fraud. The spin off from this rate fiasco is that the rating agencies have some fast talking to do in order to repair their status.

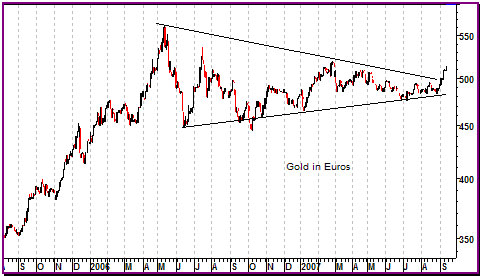

Irrespective of the reasons the gold price against all leading currencies has broken upside out of the triangular patterns with a typical surge. The full implication is that gold has once again become the centre pivot of the currency system and there is a worldwide flight to protection.

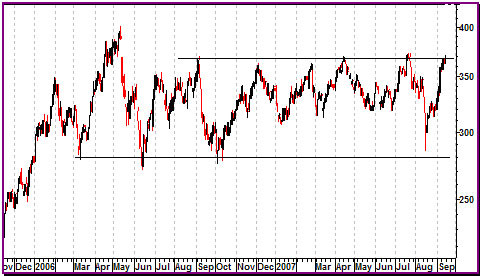

When the triangular breakout on the bullion price is transposed onto the share charts there are some huge potential upsides out of the massive 18 month period of churning. My long term counts indicate that over the next three years we could easily see a trebling of share prices if not greater leverage.

Meanwhile the Dow bounced back upside to hit the 61.8% retracement level of 13 450 on the nail before moving into a churning pattern. I remain bullish on global equities and continue to look for the Dow to hit my long term target of 15 500. A new push above the resistance level at 13 400 will confirm the continuation of the major bull trend. As I have so often detailed, sudden falls in stock prices are usually the final C wave sell off from an old correction and not the start of a new bear market. I stick to this analysis for the equity sell off. I rate it as a serious buying opportunity and not a period in which to panic...

Bullion shot out of the confines of the triangular pattern as has the gold price in sterling and Swiss Francs.

In the last issue I detailed that large scale triangular patterns of this type usually lead to very strong upside catapults once the breakout occurs and that the break above $680 would trigger this upside break. This has occurred and bullion has entered a new bull market phase. The first stage upside target out of this triangle is $850.

The Euro price of gold also had the same triangular pattern and the move above E500 was be the signal for the breakouts by bullion against all the other currencies. In the short term the gold prices are overbought but I only expect a few days breather before a resumption of the main bull trend. There are no dangerous divergence signs.

The HUI Goldbugs index has been trading inside a rectangular pattern for the past 18 months. This same pattern is reflected across the board on the global gold indexes. It needs a break above the top resistance line to trigger a new and powerful bull trend. So far the sharp bounce has only played catch –up. The real bull trend has yet to start.