Demand

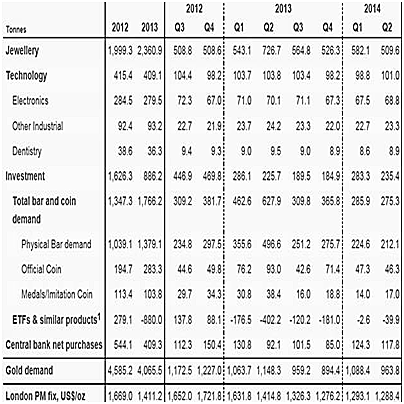

Global gold demand was 964 tons in Q2/14, significantly reduced from the record high in Q2/13.

ETF outflows slowed sharply.

Central banks continued to buy gold for the 14th consecutive quarter in Q2/14. CB's purchased 118t in Q2/14 up 28% over Q2 2013. The announcement of a fourth CBGA in the second quarter also reiterated that sales will not be forthcoming from some of the largest holders.

Jewelry demand weakened year-on-year, but the broad, 5-year uptrend remains intact. Jewelry accounted for 53% of gold's global demand and is by far and away the anchor of gold's market.

World Gold Council

Supply

China is the largest producer in the world, accounting for around 14% of total production. East Asia as a whole produces 21% of the total newly-mined gold. Latin America produces around 18% of the total, with North America supplying around 15%.

Around 19% of production comes from Africa and 5% from Central Asia and Eastern Europe.

Recycling accounts for around one third of the total supply of gold.

Thanks to the World Gold Council you now know where gold comes from, whose buying it and what they use if for.

Deeper into the #'s

Gold comes from three sources:

- Central Banks - sales stopped and are staying stopped.

- Recycling – mostly flat in 2014.

- Mining

Global gold demand across all sectors in 2013 was 4,065.60 tons.

The top 2013 six gold producing countries—China 420 tons, Australia 227 tons, U.S. 226 tons, Russia 220 tons, Puru 150 tons, South Africa 145 tons and Canada 120 tons—together produced 1,653 tons.

Other top gold producing countries include Mexico 100 tons, Ghana 85 tons, Brazil 75 tons, Indonesia 60 tons and Chile 55 tons.

According to GFMS estimates total gold mine supply reached 2,982 tonnes in 2013, up 4.1% from 2012.

High Grading & Refocusing

Two mostly unrecognized influences are at work in the global gold market, unsustainable production levels and a shifting of demand focus.

Many miners are processing greater quantities of ore to maintain revenue and contain costs at today's lower gold prices.

It's also very possible some companies are focused on solely mining the higher grade portions of their mines. The result is higher production and lower costs over a short term, but it is not sustainable and means a much higher gold price is needed to economically mine the lower grades left.

The focus of the gold industry is shifting east.

The key driver of gold's price over most of the last decade was institutional investors buying gold bullion through exchange-traded funds (ETF). That changed in 2013 with investors dumping 800 tons or 31M oz.

On the other side of the trade was an enormous physical, almost insatiable, gold demand coming from Asia. According to GFMS China imported unprecedented amounts of gold from the rest of the world and became the world's largest consumer of jewelry last year, with demand rising 30% to 724 tonnes.

The Quest for Gold

Here's a few facts from SNL Metals & Mining's 2014 edition of 'Strategies for Gold Reserves Replacement.'

Over the past two dozen years mining companies have discovered 1.66 billion ounces of gold in 217 major gold discoveries. That's a lot of gold!

But it wasn't enough—there were 1.84 billion ounces produced over the same period. That's a shortfall of 180 million ounces of gold for reserve replacement over the 24-year period or a shortfall of 7.5 Moz a year.

The amount of gold discovered and the number of major discoveries has been trending downward - from 1.1 billion ounces in 124 deposits discovered during the 1990s to 605 million ounces in 93 deposits discovered since 2000.

"The amount of potential production from these major discoveries is particularly concerning when looking at the discoveries made in the past 15 years. Assuming a 75% rate for converting resources to economic reserves and a 90% recovery rate during ore processing, the 674 million ounces of gold discovered since 1999 could eventually replace just 50% of the gold produced during the same period.

However, considering that only a third of the discovered gold has been upgraded to reserves or has already been produced, and that many of these deposits face significant political, environmental or economic hurdles, the amount of gold becoming available for production in the near term is certainly much less.

Between 1985 and 1995, 27 mines with confirmed discovery dates began production an average of eight years from the time of discovery. The time from discovery to production increased to 11 years for 57 new mines between 1996 and 2005, and to 18 years for 111 new mines between 2006 and 2013.

The length of time from discovery to production is expected to continue trending higher: 63 projects now in the pipeline and scheduled to begin production between 2014 and 2019 are expected to take a weighted-average 19.5 years from the date of discovery to first production." Kevin Murphy, mining.com

Conclusion

The production of mined gold remains well below market demand. As long as demand exceeds mined supply how can gold's bull run be over? Your author doesn't believe it can be.

The best way to profit is to buy when everyone else has sold and assets are at rock bottom prices. That would be now.

Your best bet for high returns will be to invest in junior resource companies.

After all, they find the deposits, so they own the world's future mines, yeah that's right, junior resource companies own the gold the gold miners need to replace their reserves.

Why don't we all ignore the endless bombardment of economic white noise spewing from mainstream media outlets and instead concentrate on gold's fundamental supply problems?

I've got a couple promising junior gold companies on my radar screen. Do you have a few on yours?

If not, maybe you should.

Richard (Rick) Mills

Ahead of the Herd