That seemingly unstoppable Juggernaut of consumption, the USA ever continues to increase its demand for metals and minerals—an annual growth rate in likely demand that is certainly being exceeded in developing nations as they aspire to an ever improving lifestyle. This will put increasing pressures on the global resource industries to keep up with demand as economic mineral deposits are perhaps becoming ever scarcer, although extraction technologies are almost certainly improving.

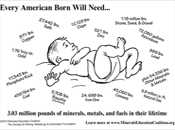

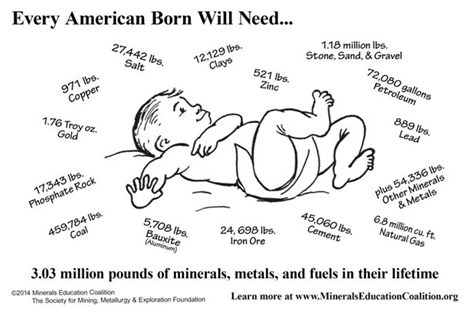

On this subject, the Minerals Education Coalition (MEC) of the Society for Mining, Metallurgy & Exploration (SME), the U.S.'s professional body for mining engineers, metallurgists and exploration geologists, has thus just released the 2014 "Minerals Baby" graphic. Each year, the amount of metals, minerals and energy fuels needed for the average American is incorporated into this iconic graphic. This year's statistics reflect an increase of more than 24,000 lbs during a lifetime when compared with the previous year's per capita usage.

The SME is keen to disseminate this graphic to a broad audience as it serves to emphasize to the American public how important the resource industry is to their way of life. Commenting on this, the SME's Executive Director, David Kanagy, says, "This annual, easy-to-read visual is used by a variety of nontechnical audiences, from educators in K-12 classroom activities, to congressional committees when referencing the need for legislative changes to federal policies that affect our mineral needs—from basic living to national defence. The value of producing this graphic is that it reminds all of us of the important role minerals have in our lives and lifestyles."

The graphic is produced using information provided by the U.S. Geological Survey, the National Mining Association, the U.S. Energy Information Administration, the U.S. Census Bureau and other sources, the MEC calculates the amount of minerals and energy fuels that are consumed in the average lifetime of an American born in the current year.

As the SME points out, the Minerals Baby graphic emphasizes the dependence that each American has on the mining industry. With the life expectancy in the United States averaging 78.7 years, the average American will need 38,524 pounds of mined resources annually to provide the products and materials on which they depend. This equates to a total of 3.03 million pounds needed during their lifetime. Multiply the annual figure by the whole American population and it equates to around 12 billion lbs of metals and minerals a year.

This obviously presents a major challenge for the global resource industry. While the U.S. is the world's biggest per capita consumer of metals and minerals, there are other areas which are coming close and in the developing world there are countries like China and India which are at a far lower per capita consumption stage, but have populations considerably in excess of that of the U.S.—and their growth rates tend to be far higher too.

With the biggest mining companies under profits pressures and thus restraining capital expenditures and cutting back on exploration, and the junior explorers, which have traditionally been the finders of many of the world's orebodies strapped for cash and largely in self preservation mode, there is likely to be a hiatus in big new project developments in the short to medium term. This will open up a big gap in the balance between supply and demand, and this time around, as consumption grows and supply remains flat, the cyclical metal and mineral price upturn could be even bigger than it has been in the past.

For the long term investor this suggests buying into, or hanging on to, resource stocks and putting them away As supply shortages develop and prices begin to soar these investments could turn into a veritable gold mine over time and a great protector against the ever-diminishing buying power of your domestic currency.

Lawrence Williams

Mineweb