SNL Metals & Mining is nowadays one of the sector's leading suppliers of statistical information having, in recent years, absorbed the highly respected Metals Ecomomics Group, based in Halifax, Nova Scotia, and Australian-headquartered Intierra, which itself had absorbed Sweden's Raw Materials Group. Its latest major report is titled Strategies for Gold Reserves Replacement and points to some hugely significant data which will affect global newly mined gold production way into the future.

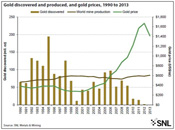

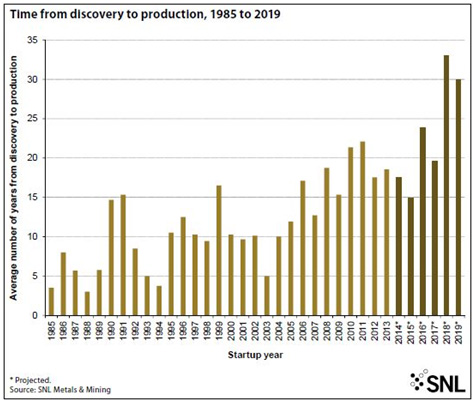

The report points out that over the past 24 years mining companies have discovered some 1.66 billion ounces of gold in 217 major discoveries, BUT—and it's a big BUT—while this may sound a huge amount, over the same period the industry has actually produced 1.84 billion ounces of gold, so discoveries have not been keeping pace with production. But the report goes much further in showing that the number of significant discoveries (defined as deposits with a minimum of 2 million ounces of contained gold) is diminishing and this diminishing trend seems to be accelerating. In the 1990s some 124 deposits containing 1.1 billion ounces of gold were discovered while since the year 2000 this has fallen to only 605 million ounces in 93 such discovered deposits. And most recently significant new discoveries appear to have slowed to a trickle.

Further, the report notes that the amount of potential production from these major discoveries is particularly concerning when looking at the discoveries made in the past 15 years. Assuming a 75% rate for converting resources to economic reserves and a 90% recovery rate during ore processing, the 674 million ounces of gold discovered since 1999 could eventually replace just 50% of the gold produced during the same period.

Furthermore, many of these deposits face significant political, environmental or economic hurdles, so, together with only perhaps a 75% conversion rate for resources to reserves and a possibly optimistic 90% metallurgical recovery rate, the amount of gold becoming available for production in the near term almost certainly well under 50% of that currently being produced.

The above chart demonstrates this shortfall in discoveries very well and shows that despite the big rise in gold price so far this century the amount of new gold discovered over the same period has dropped off dramatically over the past few years.

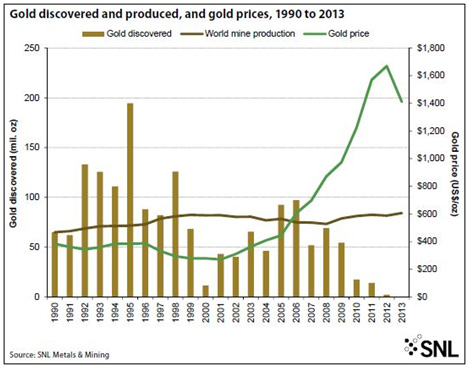

And the problem doesn't end here. It is also nowadays taking far longer to bring a new deposit from discovery through to production. SNL estimates that the 63 projects now in the pipeline and scheduled to begin production between 2014 and 2019 are expected to take a weighted-average 19.5 years from the date of discovery to first production. The trend is also getting worse.

The reasons for this are many, and well understood by the industry itself, if not always by those on the outside looking in. These include the need for increased and more detailed feasibility work, hurdles imposed by greater social and environmental awareness, longer and more demanding permitting processes, increased need for infrastructure and processing capacity due to lower ore grades and/or more remote locations, limited availability of capital, and scarcity of experienced personnel.

As it can take several years of exploration for a new discovery to be defined, it is too early to tell whether any surge in discovery-oriented exploration since 2010 has moderated the downward trend in the number and richness of new discoveries. SNL thus reckons that the tough financial environment for junior explorers over the past two years suggests that the longer-term downward trend in discoveries will likely continue for at least the next few years.

SNL's research can be criticized for perhaps being too simplistic in its approach, and relies heavily on published data which may not be forthcoming from state-owned corporations—notably those in countries like China, nowadays the world's largest producer of gold, which does seem to have been successful in annually raising its gold output. For example, state-owned information outlet Antaike is reported as suggesting China's gold output will grow again this year by around 7.4% to 460 tonnes. The same source also reported earlier this year that China had found 761.4 tonnes of new gold deposits in 2013—but grades and economics are seldom present in such findings! SNL data also ignores smaller deposits as well as expansions to existing operations.

Be this as it may, the SNL research, like all research of this type, does indeed indicate a serious trend which is certain to significantly impact the global gold/supply equation in the years ahead. Global gold output seems to being maintained (just) at the current time, but the suggestion is that unless there is some significant change in the rate of new discoveries, it will inevitably start to drift downwards in the relatively near future and this drift will likely accelerate. Even if exploration activity is stimulated upwards by perhaps much higher gold prices, this can have little immediate impact purely because of the enormous lead times it is now taking to get a new discovery into production.

Further details on discoveries, the gold development pipeline and capital cost spending can be found in the 2014 edition of SNL Metals & Mining's Strategies for Gold Reserves Replacement.

Lawrence Williams

Mineweb