The theme running our mailbag this morning was one of distress as various investment strategies based around the performance of the junior gold mining sector appear not to be working out as planned. We will take a quick look at the GDXJ to see if we can discern any trends that may help us position our hard-earned cash for future growth.

The GDXJ is the Market Vectors Junior Gold Miners ETF, the ticker symbol is GDXJ:NYSE.Arca, and it replicates, as far as possible, the performance of the Market Vectors Junior Gold Miners Index. As we see it the attraction of this fund for an investor is the ability in invest in a basket of junior stocks with the view that most of them will make good progress in line with a rally in gold prices and that some of them will eventually become the industries big hitters. For investors looking to find a tenbagger this could well be the place to be. There is also the possibility that the senior mining companies, who do need to keep their own pipelines well stocked, may swoop in with a lucrative offer to take over some of the more promising members of this fund. The possibilities are exciting and one day we may see a rash of takeover activity in this sector with the corresponding rise in value of this ETF.

However, there are some negatives to investing in gold miners, such as the huge amount of capital required, rising labor, energy and transport costs, and the political, managerial, technical and environmental issues all have to be resolved for a mining operation to succeed. The risk of having a larger slice of the profits being taken by a newly elected government are never far away and the risk of being nationalized is also a threat that should be taken into consideration by an investor.

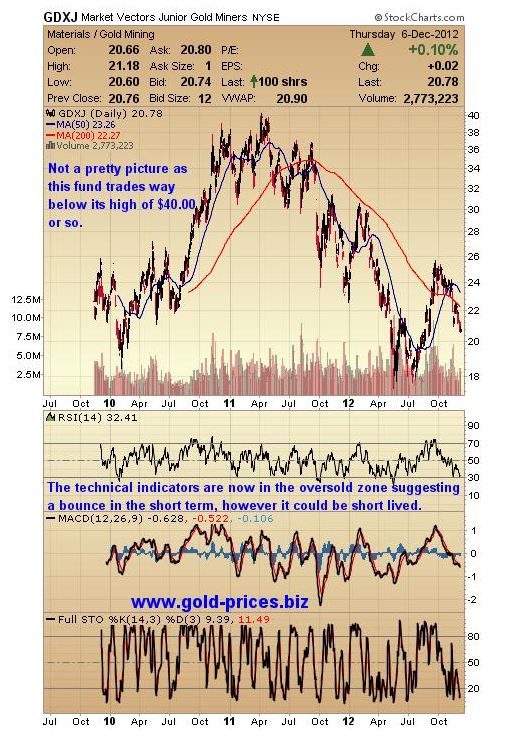

Now, if we take a look at the last two years, we can see that in January 2011, when gold was trading at around $1,400/oz, the GDXJ was trading at around $35. Fast forward to today and gold is trading at around $1,700/oz and the GDXJ is trading at $21. So gold is up 21% and the GDXJ is down about 40%. It can be argued that if we go back to when this fund was launched in late 2010, at a price of around $22, it has, indeed, held its own for three years or so. But it should be noted that the price of gold was also a lot cheaper then, trading at around $1,200/oz.

As investments go this one is not setting the world on fire and it is hard for us to take a positive view of any investment vehicle that declines when the underlying asset is rising. On the other hand Baron Rothschild once said that “The time to buy is when there's blood in the streets." So, maybe we are now at that point when the damage has been done and this fund is now in the process of forming its lows.

For now this investment does not appeal to us but we will observe its progress and report back to you if and when we think a real bargain is on offer. If you are of the opinion that the lows are in and this is now a very good time to invest please feel free to add your opinion, it will help to get some semblance of balance into this debate.

GDXJ trades on the NYSE and has a market capitalization of $2.77 billion; a 52-week high of $30.55 and 52-week low of $20.66, the liquidity is good with more than 3 million shares traded per day.

Take care.

Bob Kirtley

URL: www.skoptionstrading.com

www.gold-prices.biz

Email: [email protected]

Disclaimer: www.gold-prices.biz or www.skoptionstrading.com makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level or risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success.