In July 1944, delegates from 44 nations met at Bretton Woods, New Hampshire—the United Nations Monetary and Financial Conference—and agreed to "peg" their currencies to the U.S. dollar, the only currency strong enough to meet the rising demands for international currency transactions.

Member nations were required to establish a parity of their national currencies in terms of the U.S. dollar, the "peg," and to maintain exchange rates within plus or minus one percent of parity, the "band."

What made the dollar so attractive to use as an international currency was each U.S. dollar was based on 1/35th of an ounce (oz) of gold, and the gold was to held in the U.S. Treasury. The value of gold being fixed by law at US$35/oz made the value of each dollar very stable.

The U.S. dollar, at the time, was considered better then gold for many reasons:

- The strength of the U.S. economy

- The fixed relationship of the dollar to gold at $35/oz

- The commitment of the U.S. government to convert dollars into gold at that price

- The dollar earned interest

- The dollar was more flexible than gold

There's a lesson not learned that reverberates throughout monetary history; when government, any government, comes under financial pressure they cannot resist printing money and debasing their currency to pay for debts.

Let's fast forward a few decades. . .

The Vietnam War was going to cost the U.S. $500 billion (B). The stark reality was the U.S. simply could not print enough money to cover its war costs, its gold reserve had only $30B, most of its reserve was already backing existing U.S. dollars, and the government refused to raise taxes.

In the 1960s President Lyndon B. Johnson's administration declared war on poverty and put in place its Great Society programs:

- Head Start

- Job Corps

- Food stamps

- Medicaid

- Funded education

- Job training

- Direct food assistance

- Direct medical assistance

More than four million new recipients signed up for welfare.

During the Nixon administration welfare programs underwent major expansions. States were required to provide food stamps. Supplemental Security Income (SSI) consolidated aid for aged, blind, and disabled persons. The Earned Income Credit provided the working poor with direct cash assistance in the form of tax credits and welfare rolls kept growing.

"The problem with Socialism is that eventually you run out of other people's money."—Margaret Thatcher

Bretton Woods collapsed in 1971 when Nixon severed the link between the dollar and gold (known as the Nixon Shock because the decision was made without consulting the other signatories of Bretton Woods; even his own State Department wasn’t consulted or forewarned). The U.S. dollar was now a fully floating fiat currency and the government had no problem printing more money.

Because of the massive printing of the U.S. dollar to cover war and welfare reform costs Nixon worried about the strength of his country's currency.

Recognizing that the U.S., and the rest of the world, was going to need and use more oil, a lot more oil, and that Saudi Arabia wanted to sell the world's largest economy (by far the U.S.) more oil, Nixon and Saudi Arabia came to an agreement whereby Saudi oil could only be purchased in U.S. dollars. This caused an immediate and strong global demand for U.S. dollars.

"Beginning in the mid-1970s the American Century system of global economic dominance underwent a dramatic change. The oil price shocks of 1973–1974 and 1979 suddenly created enormous demand for the floating dollar. Oil importing countries from Germany to Argentina to Japan, all were faced with how to acquire export-based dollars to pay their expensive new oil import bills. The rise in the price of oil flooded OPEC with dollars that far exceeded domestic investment needs, and were therefore categorized as "surplus petrodollars." A major share of these oil dollars came to London and New York banks where the new process of monetary petrodollar recycling was initiated.

In 1974 U.S Assistant Treasury Secretary Jack F. Bennett and David Mulford of the London-based Eurobond firm of White Weld & Co set about the mechanism to handle the surplus OPEC petrodollars. Kissinger, Bennett and Mulford helped orchestrate the secret financial arrangement with the Saudi Arabia Monetary Agency (SAMA) that creatively transformed the high oil prices of 1973–1974 to the direct benefit of the U.S. Federal Reserve banks and the Bank of England.

Despite the financial windfall enjoyed by the U.S./UK banking and petroleum conglomerates who 'managed the recycling of petrodollar flows,' most Americans regard the 1973–74 oil shocks as a particularly painful time period of high inflation and long lines at every gas station. In the Third World these high oil prices created huge loans from the International Monetary Fund—debts to be re-paid entirely in dollars." —petrodollarwarfare.com

By 1975 all OPEC members had agreed to sell their oil only in U.S. dollars.

The U.S. Dollar Today

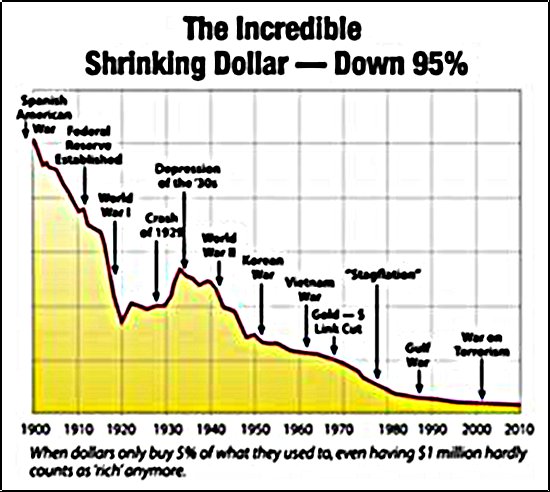

(Chart: republicbroadcasting.org)

The dollar lost 95% of its value from 1913 (inception of the Federal Reserve) to 2010. Nixon cut the Bretton Woods tie to gold in 1971 and did the oil for U.S. dollars deal with Saudi Arabia in 1973.

Current Account Deficit

The more popular the worlds reserve currency is relative to other currencies (remember Nixon's deal with the Saudis?), the higher its exchange rate and the less competitive domestic exporting industries become. This causes a trade deficit for the reserve currency issuing country—the United States is running the largest current account deficit in the world.

The current account is the difference between the value of exports of goods and services and the value of imports of goods and services. A deficit then means that the country is importing more goods and services than it is exporting.

The U.S. current account deficit for 2011 was $473.4B or 3.1% of GDP. A sustainable current account deficit is considered to be in the 2–2.5% range.

A country's current account deficit may become unsustainable if it is unable to secure the necessary financing—countries like China are shunning U.S. Treasuries,

"In 2009, such foreign purchases of U.S. debt amounted to 6% of GDP and has since fallen by over 80% to a paltry 0.9%."—Money News article

The Federal Reserve bought approximately 61% of all government debt issued by the U.S. Treasury Department in 2011.

This is called "monetizing the debt"—printing money to buy your own debt is the most inflationary thing a country can do.

Trade imbalances—deficits and surpluses—between nations are one of the major reasons for financial crises.

Fiat versus Bretton Woods

"Today's fiat monetary system as compared to the Bretton Woods system:

- Economic growth is a full percentage point slower, with an average annual increase in real per-capita GDP of only 1.8%

- World inflation of 4.8% a year is 1.5 percentage point higher

- Downturns for the median countries have more than tripled to 13% of the total period

- The number of banking crises per year has soared to 2.6 per year, compared to only one every 10 years under Bretton Woods

Moreover, abandoning the gold standard in favor of free floating currencies was supposed to eliminate currency crises and lead to an automatic adjustment in trade imbalances. Instead:

- The number of currency crises has increased to 3.7 per year from 1.7 per year

- Current account deficits have nearly tripled to 2.2% of world GDP from only 0.8% of GDP under Bretton Woods

These results demonstrate beyond a reasonable doubt that the experiment with floating paper currencies has been a disaster for the people of the world."—Charles Kadlec, An International Gold Standard Beats the Rule of the Governing Elite, forbes.com

Gold Today

Gold purchases by the world’s central banks soared from 77.0 tonnes in 2010 to 439.7 tonnes in 2011.

According to the World Gold Council (WGC) this reflects "the need to diversify assets, reduce reliance on one or two foreign currencies, rebalance reserves and ultimately protect national wealth."

Has it only taken 41 years, 1971–2012, for the world's governments to realize. . .

"The commodity used most successfully for money to date has been gold."—John Tomlinson, Honest Money. . .

and that. . .

"Paper money eventually returns to its intrinsic value—zero."— Voltaire, 1729

Investors certainly understand gold's role in the monetary system.

Record investment demand lifted global gold demand to an all-time high in 2011—4,067 tonnes. The main driver for this increase was the investment sector where annual demand was 1,640.7 tonnes, up 5% from the previous record set in 2010.

"What is certain is that the long-term fundamentals for gold remain strong, with a diverse and growing demand base, coupled with constrained supply side activity."—Marcus Grubb, managing director for investment at the World Gold Council

Conclusion

In the time of the ancient Babylonians—long before the periodic table—there were seven sacred metals: gold, silver, copper, iron, tin, lead and mercury.

In Roman and Greek mythology, the First Age was called Golden, the Second Age Silver.

Gold and silver have played a role in most countries' currency systems for well over two thousand years.

The history of fiat money has always been one of failure (most paper money economies' downfall can be linked directly to the costs of financing out of control military growth and its wars). Every fiat currency since the Romans started diluting the silver content of their denarius has ended in devaluation and eventual collapse of both the currency and of that particular economy.

Silver and gold have stood the test of time, as a medium of exchange, a storehouse of value and a safe haven in times of turmoil.

Gold remained the basis of the monetary system until 1971.

For the very first time in our history, all money, all currencies, are now fiat—the U.S. dollar use to be gold backed and it was the rock all the worlds currencies were anchored to—when the U.S. dollar became fiat, all the worlds currencies became fiat.

Our 41-year experiment with paper money is almost over. This fact should be on all our radar screens. Is it on yours?

If not, maybe it should be.

Rick Mills, Ahead of the Herd

If you're interested in learning more about the junior resource and biomed sectors please come and visit us at www.aheadoftheherd.com. Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Uranium Miner, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, and the Association of Mining Analysts.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.