The last two-and-a-half months were a classic example of why I have been warning traders not to short the stock market. These creeper trends can go on much longer than many people expect and shorts just end up getting whipsawed out multiple times until they're so shell shocked that they can't hold on when they finally do catch the top.

All in all the correct strategy was to remain in cash until the profit-taking event occurred and then buy as close to the bottom as possible.

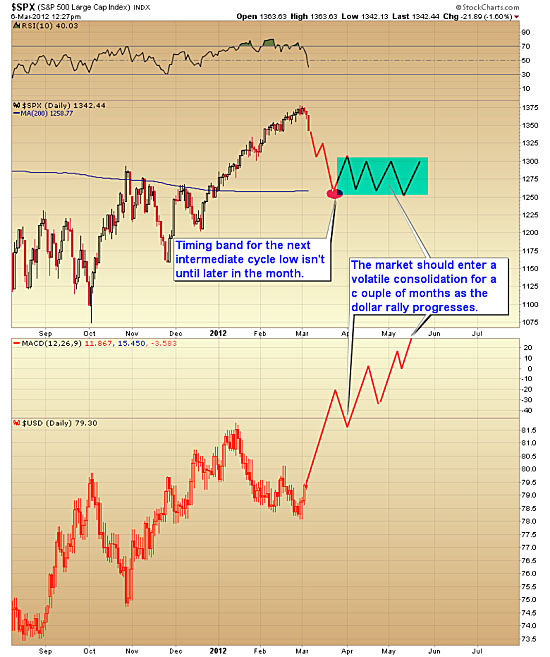

If I had to guess I would say this will probably turn into a two-step-down affair followed by a two-month volatile consolidation as the dollar rally progresses.

You might recall in my last post I mentioned that the dollar would need to get on the upside of an intermediate cycle before stocks had any realistic chance of correcting. I outlined the conditions that would confirm that the dollar had formed an intermediate cycle low. Those conditions have now been met and it appears that the stock market is ready to deliver the much-anticipated profit-taking event.

During this period, gold should drift generally downward over the next couple of months as the dollar rallies.

There will be plenty of false rallies (just like last Thursday) to sucker traders back in. But I really doubt gold will put in a lasting bottom until the dollar's intermediate cycle tops. Barring a public announcement of QE3, that is unlikely to happen until sentiment reaches extremes again. That almost always requires a move to new highs and usually takes a minimum of one-and-a-half to two months to generate that kind of bullish sentiment.

As I have been warning traders for months, the dollar's rally out of its three-year cycle low almost certainly isn't done yet. The rally out of a three-year cycle low usually lasts at least a year, and that's the norm in a secular bear market. Since the three-year cycle low bottomed in May 2011, it's unlikely that we would see a final top until at least May of this year. And since the three-year cycle low in 2011 held above the three-year cycle low that occurred in 2008, there is even a case to be made that the dollar has now entered a secular bull market.

This would imply that despite Fed chairman Ben Bernanke's best efforts, the forces of deflation may be overwhelming the central bank's efforts to reflate. However, I'm confident that if $10 trillion (T) isn't enough, Bernanke will not hesitate to print $50T. I have little doubt that no matter how this progresses it is going to end in a massive inflationary currency crisis.

Toby Connor, Gold Scents