Gold has been pulling back the past couple of trading sessions on light volume with healthy price action. It has done the opposite of what the dollar did above. Gold broke through a key resistance level and is slowly drifting back down to test the breakout level to see if it is support. If so, then gold should continue higher in the coming days.

Both silver and gold miner stocks are lagging behind the price of gold. They have yet to break through their key resistance levels. That being said, it could happen any day now as they have both been flirting with that level for a couple of trading sessions now.

Crude oil continues to hold up strong and is headed straight for its key resistance levels without any real pullback. Chasing price action like this is not something done often because risk:reward is not in your favor. I am staying on the sidelines for oil until I see a setup that has more potential and less risk.

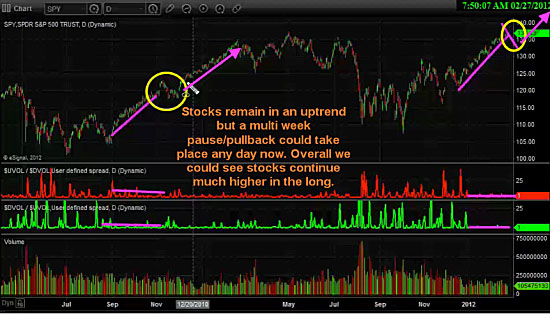

The equities market remains in a strong uptrend at this time. I do feel a one-to three-week pause/pullback could take place at any time, but in the grand scheme of things we could be only halfway through this runaway stock market rally as noted in the video (see link below).

The equities market is going to gap down this morning, which is typical in a bull market. Remember: In an uptrend the stock market tends to gap lower at the open and close higher into the close. And it’s the opposite in a downtrend, with stocks gapping higher and sell off through the trading session.

Watch my detailed video analysis for this week: http://www.thetechnicaltraders.com/ETF-trading-videos/

Chris Vermeulen, The Gold and Oil Guy

www.TheGoldAndOilGuy.com