Gold is the Odysseus of the markets, destined to wander the hinterland of the financial world for years without achieving the deserved safe haven status. Like Odysseus, gold will eventually arrive and the general population will embrace it for what it is, the one and only store of wealth that exists today. Loathed and assailed by the mainstream press, gold is deliberately kept hidden in the financial shadows by those that continue to shovel out paper "assets" like so much manure. Right now the dow is all the rage with the press, as it preaches the gospel of the U.S. stock market as a port in the storm. They do so with an old-time religious fervor that would make a snake oil salesman blush. The object of the message is to pry that last penny from the hands of the last widow and orphan left standing. Value be damned! There is always a greater fool out there who will want your paper asset at some higher price.

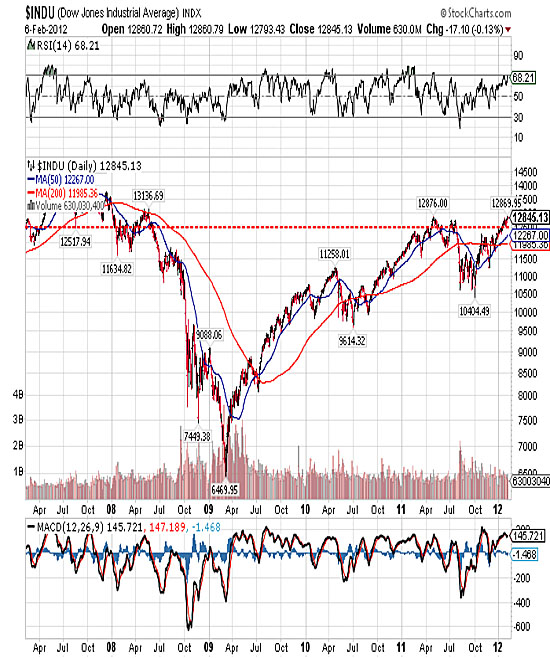

No one cares to discuss the reality of the situation. If you bought the dow five years ago you would have paid +/- 12,500, as you can see here:

Yesterday the dow closed at 12,845, so you would have gained 2% for your troubles. By the same token if you had purchased gold five years ago you would have paid US$660/ounce (oz), as you can see below:

Yesterday, spot gold closed at $1,723/oz, so you would have gained 160%. If you want to go back ten years, it gets worse. The dow would have risen 32% versus gold, which is up more that 350% for that same time period. In fact, you can compare gold against almost anything (that can be found in a liquid market) and at best all the rest come in a distance second.

So why is gold almost universally despised by politicians, central banks and money managers? Simply put, it's the one thing that can't be legislated into existence or created by the touch of a keyboard. Gold implies discipline and that's something that a politician or a central banker cannot tolerate under any circumstances. Financial discipline, the ability to live within your means, is something that's been in very short supply for the past four decades. In fact, unless you are a child of the Great Depression, and there are very few left, you don’t even understand the concept of discipline. Why buy gold when you can simply print another dollar and it is accepted anywhere you go?

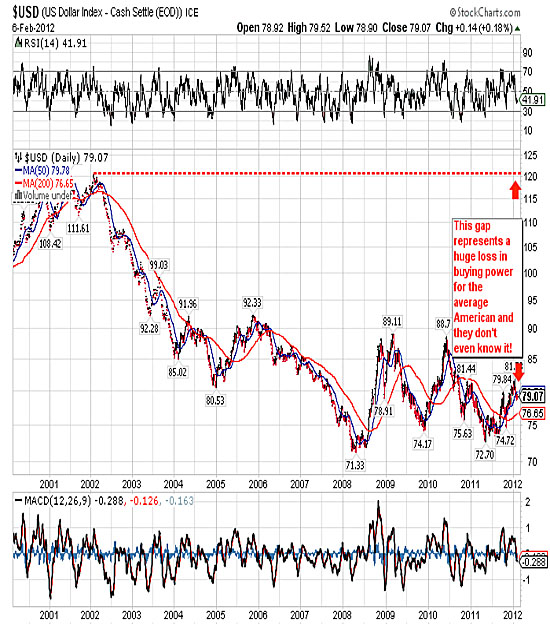

I guess on the surface that might not seem so bad, but when you start to dig down a little bit it looses it luster. Take a look below at what's happened to the U.S. dollar compared to a basket of its competitors over the last ten years (dashed horizontal red line) and you’ll see what I mean:

It's fallen from 121 to 79, meaning that it lost 35% of its value in real terms! Remember that 32% gain in the dow for the last ten years? Well folks, it's really a 3% loss, since stocks are denominated in U.S. dollars!

That's all well and good, and I suppose I could go on to tell you how demand continues to outpace production, that central banks are printing fiat money at an increased rate, or that central banks are now net buyers of gold, or how countries like China and India are now buying production straight from the mine, making it more and more difficult for the paper gold market (futures) to meet its obligations, the coming derivatives implosion and so on. . .but you've heard all of that before. Instead I want to talk to you about the coming external shock that will highlight this new third phase of our gold bull market.

The shock will originate in the Middle East, but it will resonate around the world for quite some time. Egypt is experiencing a new wave of social unrest as recent promises are forgotten, Syria is undergoing a wave of brutal repression, and Iran continues to develop its nuclear capabilities for whatever means. On the one hand you have Israel and a somewhat reluctant U.S., while on the other hand you have Iran, Syria, Egypt, a hand full of factions in several other countries like Iraq—and they are all backed by Russia and China. Why would they risk war? They don't want any more Middle Eastern oil falling into American hands!

All major industrialized nations are still dependent on fossil fuels and that includes Russia and China. They don't relish the idea of having to go with their hat in their hand to the U.S. and ask for oil. Then you have Israel hell-bent on attacking Iran and dragging the U.S. along for good measure. Yesterday the U.S. implemented a second wave of sanctions against Iran in the hopes of staving off an attack, but I think the handwriting is on the wall. The attack, when it occurs, will bring about retaliation from China and Russia. Once that occurs you're just a heartbeat away from "out of control." Given the complete lack of leadership in the U.S., you can see the potential for disaster.

I believe gold is sensing all of this and that is another factor as to why any reaction at this point and time will be short lived. As you can see in this nine-month chart:

Gold broke out to the upside two weeks ago, and in spite of a two-day reaction the uptrend remains intact. Gold did make a lower low this morning at $1,709/oz, just above decent support at $1,704.50/oz, and has recently moved higher. It is currently trading at $1,732.40/oz and I would not be surprised if we saw the bottom of the reaction earlier this morning. I’ve drawn in two support lines (black horizontal dashed lines), and the lower one at $1,665/oz should hold under any circumstance. Resistance will come at the old lower highs of $1,767.10/oz and then again at $1,804.40/oz.

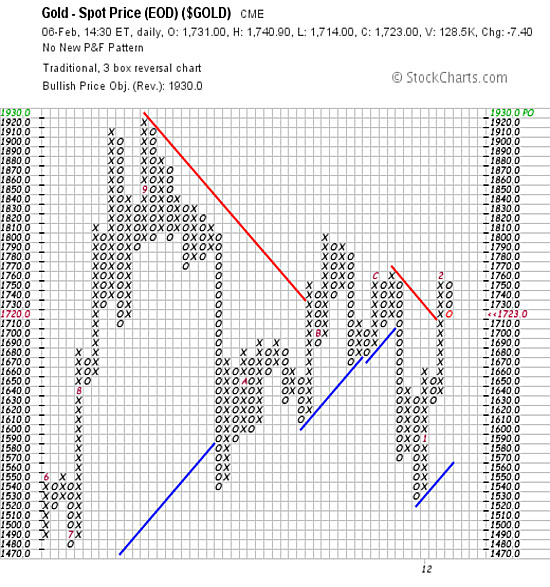

General market conditions are enough to drive the price of gold higher and that is reflected in this Point & Figure chart:

So just on price action alone gold can go to $1,930/oz, but I believe that we're going to get a lot more upward pressure than anyone thought possible and that will drive gold much higher than anyone imagined. Once the big boys start throwing darts at each other all sorts of unintended consequences will occur. Gold is unique in that it can be subject to both greed and fear at the same time, and that will prove to be a significant driver.

Watch both the dollar and gold, as they will act as canaries in the coal mine and start to move fast and hard in opposite directions as those in the know protect them selves. I have been recommending to my clients the purchase of both gold and silver since late December, and human nature being what it is they have been slow to react (just like the rest of the investing world). If its possible to recommend gold and silver even more, I do so today. I bought as close to the low today, at +/- $1,708/oz, as I could, and I will buy a breakout to a higher high once it occurs. Both are going much higher and I expect to see the $1,930/oz target hit by late spring. Gold is going to $4,500/oz by late 2014, and that's good enough for me. Silver will go to a minimum of $165/oz, and could go much higher. Those who buy today probably will not remember the moment, but those who don't buy will live to regret it.

Giuseppe L. Borrelli, www.unpuncturedcycle.com

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle web site (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What’s more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.