On the economic front we see that for the month of October personal income had gained 0.4% while spending had increased 0.1%. For November, economists polled by MarketWatch had expected personal income to gain 0.2%, and for spending to also rise 0.2%. Meanwhile, there was no growth in November for the price index for personal consumption expenditures, though this inflation gauge is up 2.5% from the prior year. The core inflation reading, which excludes volatile food and energy costs, rose 0.1% in November, matching economists' expectations. Compared with the prior year, core inflation is up 1.7%. The personal saving rate declined to 3.5% in November from 3.6% in October, and is down considerably from the 7.1% rates we saw during the summer. Finally, we see that credit card debt increased considerably during the month of October.

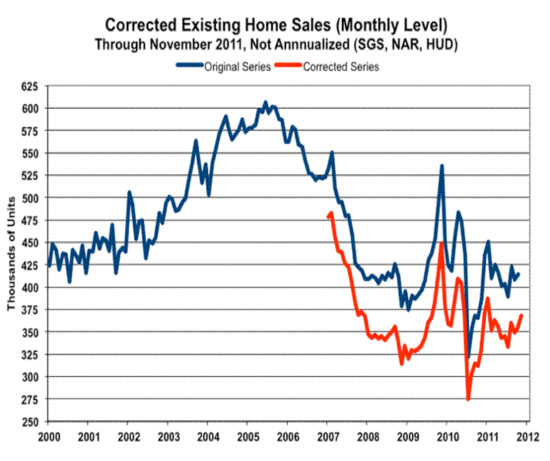

In an interesting note, the National Association of Realtors (NAR) corrected its estimates of existing home sales today (December 21), and 3.54 million previously reported home sales vanished, in revision, since January 2007. Put in perspective, the amount of sales wiped out was the total amount of seasonally adjusted existing home sales that previously had been reported in 2011, through October. Post-2006, 14.3% of existing home sales were eliminated, with sales in the Northeast taking a 30.9% hit, followed by a 14.2% reduction in the Midwest, a 12.3% loss in the South and a 5.3% loss in the West:

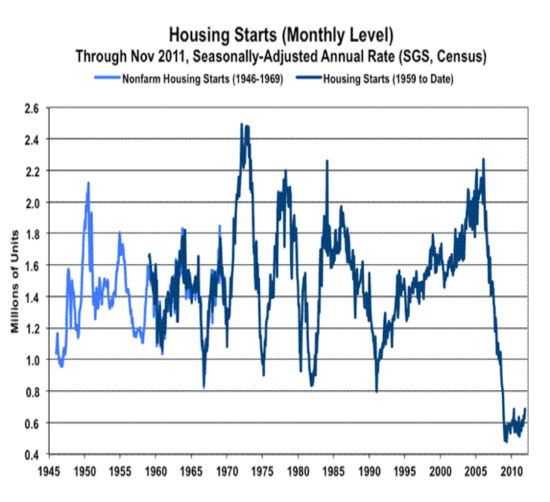

Finally, as you can see below, the housing starts remained abysmal, well below the lowest levels going back to World War II:

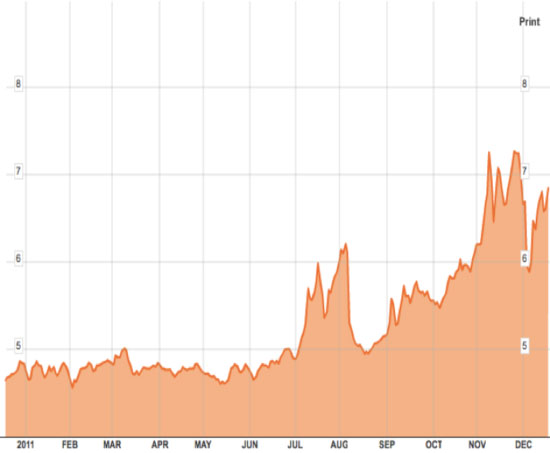

If we look overseas we can see the yields for sovereign debt in Spain, Portugal, Ireland and Italy are beginning to move higher once again, and this is just three days after the European Central Bank (ECB) burned 489B euros in a futile attempt to add liquidity to the European Union (EU) banking system. The Italian 10-year bond yield crossed back above 7% this morning and that is considered by many to be the point of no return:

The current yield stands at 7.064% and is generally considered to be beyond the means of the Italian government. A reasonable level would be 5% or less!

In spite of the momentary flashes of economic growth, the world economy continues to decline as deflationary pressures gradually increase. This is one of the reasons gold has floundered of late; that, combined with the fact that it had rallied close to 50% by the time it reached the September high. If you want confirmation that the world’s economy is slowing, you can simply look at China, the exporter to the world. Here you can see that the Shanghai Exchange has been declining for more than two years:

What’s more, over the last couple of weeks it’s made one new multiyear closing low after another! Finally, you can see that the decline is gaining strength, and that’s an indication that deflation is gaining strength.

In spite of the problems gold has been grinding high over that same period, as you can see below:

In spite of the recent and much publicized decline in the price of the yellow metal, it is still up $220.30/oz or 15.91% for the year, but no one ever mentions that. What’s more, that’s almost double the gains in the dow, and it beats oil, cotton and copper by a wide margin. The only thing to produce a bigger gain was the U.S. 30-year treasury bond, up by close to 17%.

With respect to the short-term outlook for gold, we can see that it is trading below the 200-day moving average (dma), the Relative Strength Index (RSI) recently fell as low as 29.00 and the Moving Average Convergence/Divergence (MACD) was at the low for 2011. These are points at which investors historically step in and buy the yellow metal:

After making an all-time high in September, gold has traced out two lower highs and one lower closing low and became extremely oversold in the process. The final leg up to the all-time high began from $1,478.30/oz and ran $445.40 to the $1,923.70/oz top. The decline down to the September low of $1,535.00/oz retraced almost 87.5% of the leg up and then bounced. As I mentioned in a previous report it is not unusual to see a reaction retrace all, or almost all, of such a vertical move higher and you can see that the reaction stopped right at strong support from a trend line going back to an old high.

From the September low gold rallied $269.40 to $1,804.40/oz, retracing 60% of the original decline. This is significant because gold retraced more than 50% of the decline, thereby indicating that we would eventually see a retest of the September all-time high. Then, of course, gold did the opposite and fell back down to an intraday low of $1,562.50 earlier this month, a higher intraday low but a lower closing low. Since then gold has stumbled and fumbled its way back up to $1,607, but still under the 200-dma at $1,619.90. Many analysts mistakenly think that the break of the 200-dma marks the end of the bull market, but over the last 10 years we’ve seen the 200-dma broken on four separate occasions, and yet gold continued to move higher. This time around will be no different.

Strong Fibonacci support is found at $1,522.20, then down at the old low of $1,478.30, and then we have a trend line that comes in at +/- $1,503.00, so we can say we have a range of support. Meanwhile, Fibonacci resistance is at $1,671.50, and then again up at $1,756.20, but the real key will be posting a higher high, above $1767.10.

Both the U.S. and EU have made it abundantly clear that they have no intention of implementing an intelligent coherent plan. Instead they will print, because it’s the easiest thing for them to do, in droplets at first and then in torrents. That will destroy both the dollar and the euro and it will ultimately drive gold higher than anyone anticipated just a couple of years ago. What’s more, the general public has yet to dip its toe into the gold bull market, but it will as it searches for shelter from the storm. That phase of the bull market will drive gold to a minimum of $4,500/oz, with relatively few interruptions along the way.

Finally a lot of people are convinced that we’ll see inflation, but if deflation occurs a lot of people believe that gold must decline. It’s worth remembering that during the 1930-1932 deflationary depression gold rallied more than 60%. I am absolutely convinced that the debt bubble must burst and many of these insolvent countries will default as economies shrink and debt rises to unsustainable levels. Currencies will become worthless, and whether any potential deflationary effects are short-lived (like 2008) or long-term (Japan), I still want to own gold. Along with the debt bubble bursting will come a severe loss of confidence in the fiat system. . .and gold is a great hedge in this scenario. It is the only real asset that will rise in value. In a world where everyone is totally caught up in the here and now, no one expects or believes that such a thing is possible. "They will never allow that to happen" is the mantra that everyone repeats to himself or herself. Unfortunately the market is bigger than they are—a lot bigger—and when it rolls over all the printing presses in the world won’t stop it. That’s when you’ll be glad you bought gold today.

Giuseppe L. Borrelli, 12/23/11

www.unpuncturedcycle.com

[email protected]

Disclaimer: All the reports and content in the entire Unpunctured Cycle website (including this report) are for educational purposes only and do not constitute trading advice nor an invitation to buy or sell securities. The views are the personal views of the author. What’s more the author may already hold a position or positions discussed in this article. Before acting on any of the ideas expressed, the reader should seek professional advice to determine the suitability in view of his or her personal circumstances. All material in this article is the property of Unpunctured Cycle.