Is a Gold and Silver Correction Underway?

Source: Clive Maund (04/24/2024)

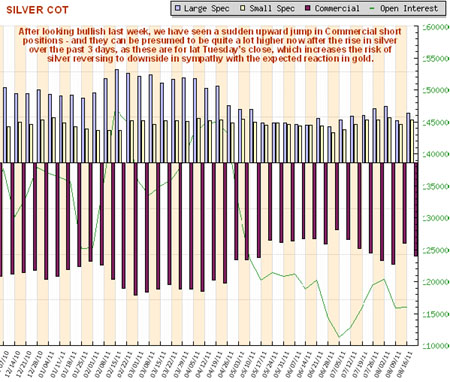

![gold and silver gold and silver]() After a drop in gold and silver on Monday, Technical Analyst Clive Maund reviews the precious metals' charts to explain why he believes it may be a good time to start adding to positions across the sector

After a drop in gold and silver on Monday, Technical Analyst Clive Maund reviews the precious metals' charts to explain why he believes it may be a good time to start adding to positions across the sector

read more >

Testing at Project in Spain Shows High Grades of Zinc, Copper

Source: Streetwise Reports (04/23/2024)

![Emerita-la-infanata-drilling.jpg Emerita-la-infanata-drilling.jpg]() Emerita Resources Corp. has announced preliminary test results from its ongoing metallurgical testing program at its wholly owned Iberian Belt West (IBW) project in Spain. Find out why one analyst called the company a "very attractive resource stock play."

Emerita Resources Corp. has announced preliminary test results from its ongoing metallurgical testing program at its wholly owned Iberian Belt West (IBW) project in Spain. Find out why one analyst called the company a "very attractive resource stock play."

read more >

Is a Commodities Super Cycle on the Way?

Source: Streetwise Reports (04/19/2024)

![commodities commodities]() Are we at the start of a commodities supercycle? We sat down with McAlinden Research to see what they had to say about the current state of commodities.

Are we at the start of a commodities supercycle? We sat down with McAlinden Research to see what they had to say about the current state of commodities.

read more >

Vancouver Explorer Sees 'District-Scale' Project in Colo.

Source: Streetwise Reports (04/18/2024)

![LAPLATACoresMMG.png LAPLATACoresMMG.png]() Metallic Minerals Corp. announces that all four holes drilled at its Newmont-backed La Plata project in Colorado intersected porphyry-style mineralization from the surface and over their entire lengths.

Metallic Minerals Corp. announces that all four holes drilled at its Newmont-backed La Plata project in Colorado intersected porphyry-style mineralization from the surface and over their entire lengths.

read more >

Gold Co. Sets New Drill Targets for Mexican Project

Source: Streetwise Reports (04/18/2024)

![CentenarioFromSite2.jpg CentenarioFromSite2.jpg]() Centenario Gold Corp., fresh off the results of its maiden drilling program at its Eden gold-silver property in Mexico, is outlining new drill targets across the property. At the same time, prices for the precious metal are taking off.

Centenario Gold Corp., fresh off the results of its maiden drilling program at its Eden gold-silver property in Mexico, is outlining new drill targets across the property. At the same time, prices for the precious metal are taking off.

read more >