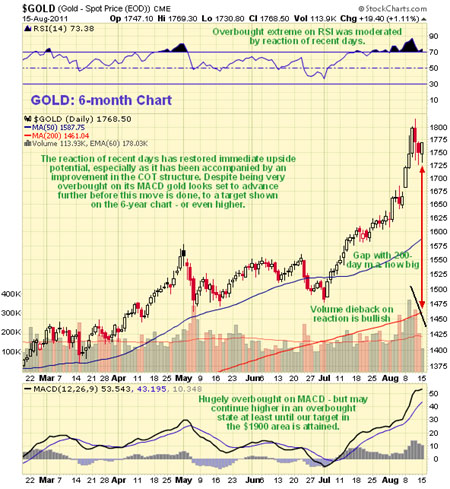

On the six-month chart we can see recent action in more detail. While it certainly looks extremely overbought on its MACD indicator on this chart, we can also see reasons why it could well continue higher over the short-term anyway, namely the moderation of the short-term overbought condition shown by the RSI indicator and the volume dieback on the reaction of recent days, which is bullish.

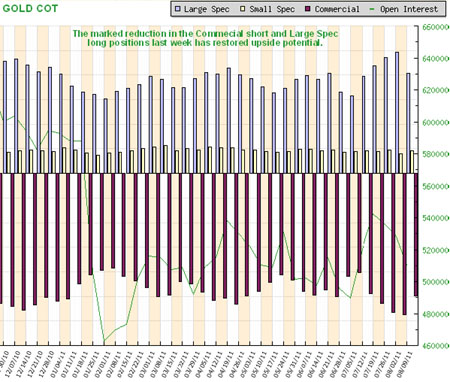

The view that gold is set to turn higher again and advance to the $1900 area before this intermediate term upleg is done is supported by the latest COT chart, which shows a marked reduction (as of Tuesday last week) in the Commercial short and Large Spec long positions—which is not what you would expect to see if gold were set to react back more heavily.

While our immediate target for gold is the $1900 area, we cannot rule out and would not be especially surprised by a "rocket move" developing soon, which would involve it blasting out of the upper channel and accelerating upwards in a parabolic arc. This would of course be likely to synchronize with a severe drop in the dollar with gold being given an added boost by the decreasing popularity of Treasuries—if only a tiny fraction of the panic money that flees into Treasuries were sluiced instead into Precious Metals, they would go ballistic.