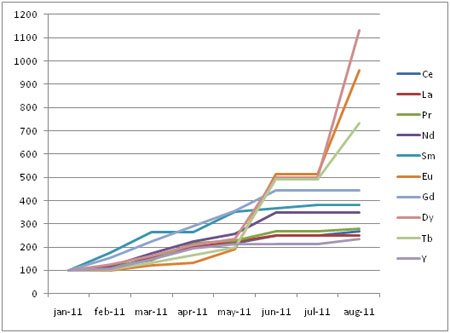

A year ago, it was China's announcement of its second half export quotas that sparked a frenzy in the world of rare earth elements. The world woke up to a perception of acute shortages in ingredients vital to our western quality of life, and the prices of individual rare earths rose dramatically. Export prices (FOB) for the so-called light rare earths (LREE) samarium and cerium showed gains of over 2,500% in 2010. The share prices of companies looking for rare earths in the ground followed suit, and made a number of early adopters significantly wealthier. This year's announcement of second half export quotas has not caused quite the same shock, but a price explosion has ensued nonetheless. This time it is the turn of the heavy rare earths (HREE).

The export prices of three HREE have exploded since China's July announcement, whilst the LREE have remained immobile. Dysprosium (Dy), arguably the most important of the rare earths due to its irreplaceability in high performance magnets that are central to many high-tech innovations, has more than doubled in a matter of weeks. Europium (Eu) and to a lesser extent terbium (Tb) are in hot pursuit. . .View full article