Don't be misled: China has only its interests at heart. Any benefits gained by other countries in this process are purely designed to serve China's interests in the long run. In fairness to China, it is following a path that would be followed by any government if in the same position of power. At this point, China appears to have no ambitions outside China other than those that would support its development.

So, what are the developments that could affect gold and silver?

China's Growth

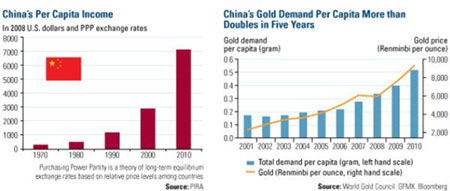

Over the last 15 years, China has been developing at an incredible rate. It has succeeded in turning itself from a relatively insignificant nation, economically, into the world's second largest economy. It exports to the whole world, has a growth rate that averages 10% over that period and has a population of 1.3 million people—all of whom are hard-working, obedient and fairly well educated. Its population is four times the size of the U.S., and its middle class is the size of the entire U.S. population.

It has become a formidable economic force at a time when military power, as a force that decides global positions has waned to the point where financial power is a greater force. And it has only just begun to walk down this road. The downside for the Chinese government is that it needs to get around two-thirds of those people into city-based employment with the remaining third of the population earning enough to stop them from becoming a source of social unrest. This is to keep its reins on power, and China will do whatever is necessary to achieve this.

Chinese Financial Imperialism

To make sure the country keeps on this helter-skelter race to full development, China has to suck in vast natural resources. It has to secure these through contracts, loans and the export of its people to make sure the flow of resources goes unabated. The different types of governments of the countries in which they are investing, is of no concern to them. It is the country's policy, and it is succeeding. For example, China invested around $5 billion in the Congo, which will go into railways and roads designed to facilitate the export of minerals from this very mineral-rich country. Should the Congo default on its loans, which is almost a given, China will accept the rights to mine and export the minerals to China.

The current foreign exchange reserves of $3 trillion (and growing) are the treasure chest that is making this possible. But more than the simple sourcing of resources, China is doing everything in its power to keep its markets in good enough condition to receive its exports. Premier Wen Jiabao's tour of Europe came with announcements of support for Europe buying Hungarian bonds (it bought Spanish bonds earlier). It may even step in to assist in a wider Eurozone crisis soon. After all, the markets of the developed world bought all those Chinese goods that kick started the country's growth. It will keep doing this for decades to come, as well; so China must assist in keeping them in good order.

The neat feature of financial imperialism is that it appears to bring immediate benefits with cheaper goods to the people of the developed world, who are seeing their spending power reduced daily as inflation rises. Obtusely, every time Europe or the States stimulates their economies (and consumers), the first to benefit is China because European and Chinese shoppers go for the cheaper goods from China. So, China's growth is set to continue well past 2020—at which time its economy will dwarf that of both Europe and the U.S. This is where its view on gold and currencies suddenly becomes more than pertinent!

China in the Currency Markets

Being one of the largest economies in the world, China must use the advantages that come with this status. One of the most important is the benefits of having a global reserve currency. We have seen the U.S. use this to extraordinary advantage over the last 60 years, and China, no doubt, will do this too.

For the last three years, China has fast-tracked the development of its banking industry and capital markets. Slowly, the renminbi (yuan) has become more widely used on the borders of China and has seen its European 'door,' Hong Kong, develop yuan capital markets. International trade is increasingly being done in the yuan. Oil and Gas will be bought from Russia in the yuan and the ruble in the future.

But the vital part of these developments is rather like the launch of a Hollywood movie. A movie will be screened first. If the screening is successful there, = it is launched across America, et al.

Chinese banks have succeeded in several launches of yuan bonds. More global customers are dealing in the yuan, and soon the yuan will be ready for its global launch. Part of Jiabao's European tour has been to promote the globalization of the yuan. So, we are now at the marketing stage of the arrival of the yuan on the world scene. If successful (and there is no reason it should not be), we'll see a huge acceleration in the use of the yuan in both commercial transactions, first, followed by capital transactions.

The global public must be able to easily access the yuan before this can happen. China and global banks are, we believe, in the process of gearing up for this event. Once ready, its arrival will be all encompassing. The accelerant to speed up the process will be either the option to pay or be paid in yuan followed by the pricing of goods solely in the yuan, forcing buyers of Chinese goods to buy yuan first—just as one has to buy the U.S. dollar to buy oil, currently.

The realignment of central bank foreign exchange reserves will be orderly but, eventually, will show a marked decline in the use of the U.S. dollar as a global reserve currency. Most countries will feel considerably less secure than they do now with the simple, single global reserve currency of the USD (i.e., Pax Americana), which will have been changed to a shared financial power base.

With such ideological and cultural differences between the two nations—nations with completely diverse political interests—the element of financial uncertainty will increase. This will favor a 'currency-counter' asset in all central bank reserves. This is where precious metals hasten to the world stage.

China and the World's Gold Markets

Mao Tse Tung banned Chinese ownership of gold back in the 1950s. Only in 2005 have citizens been able to own it as individuals. In the second quarter of 2009, China's gold reserves jumped from 600 tons of gold to 1,054.1 tons. Since then, there has been silence on China's central banks reserves. But China uses an intermediate semi-government agency to purchase its gold. It, in turn, hands over that gold once every few years to the People's Bank of China (it was seven years prior to that that they increased their reserves).

We will have to wait until China is ready to report its reserves before we know how much the central bank's buying. To us, it appears that the 454.1 tons gold bought by China from 2002–2009 could have been the entire local production. Local production has risen to 340 tons per year (tpy) and may well rise to 700 tons in the next few years. If China is buying local gold for its central bank reserves, then taking this growing production since 2009 until 2014 may see the figure of 2,000 tons added to the People's Bank of China's gold holdings. This would raise the total to 3,000 tons.

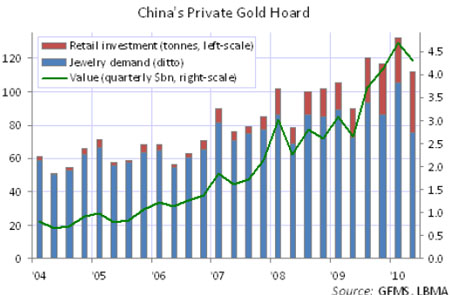

The Chinese government has licensed many local and foreign banks to import gold from outside of China. Imported gold exclusively supplies the local Chinese retail market. This tonnage is moving over 350 tpy now. It should accelerate faster than local production does in the next few years. The government also is actively encouraging this demand. In the first quarter of this year, China overtook India to become the largest market for private gold sales.

From January to March, Chinese consumers and investors bought 93.5 tons gold in the form of coins, bars and medallions. This was more than double the amount of last year over the same period. It was a 55% jump from the previous quarter.

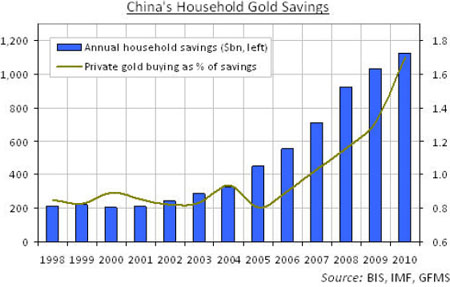

China overtaking India as the largest buyer of gold products on an annual basis is just a matter of time. The average gold holding in China is only one-fourth of the global level, and China's per-capita individual income is much higher than India's. The growth of local retail demand should move in line with the growth of China's middle classes. Expect this growth to continue in the years ahead at a minimum of 20% from this year onward. It is likely that growth will far outrun even the most optimistic projections.

It is also possible that China will buy foreign gold mines and import the gold from those mines to its reserves or retail markets. It may attempt, at least, to buy gold direct from producing nation's central banks. Local gold production is bought by the central bank and paid for in local currency. The central bank sells it on the international market for dollars and imports it direct into central bank reserves, too.

The Chinese government has made it clear that it wants gold to be bought and held inside China in both reserves and in its citizen's hands in the foreseeable future.

China's Impact on Future Gold & Silver Prices

Subscribers only; subscribe through goldforecaster.com or silverforecaster.com.

Legal Notice/Disclaimer: This document is not, and should not, be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Forecaster - Global Watch/Julian D. W. Phillips/Peter Spina, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold Forecaster - Global Watch/Julian D. W. Phillips/Peter Spina make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Forecaster - Global Watch/Julian D. W. Phillips/Peter Spina only and are subject to change without notice. Gold Forecaster - Global Watch/Julian D. W. Phillips/Peter Spina assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.